BusinessEurope Headlines No. 2021-37

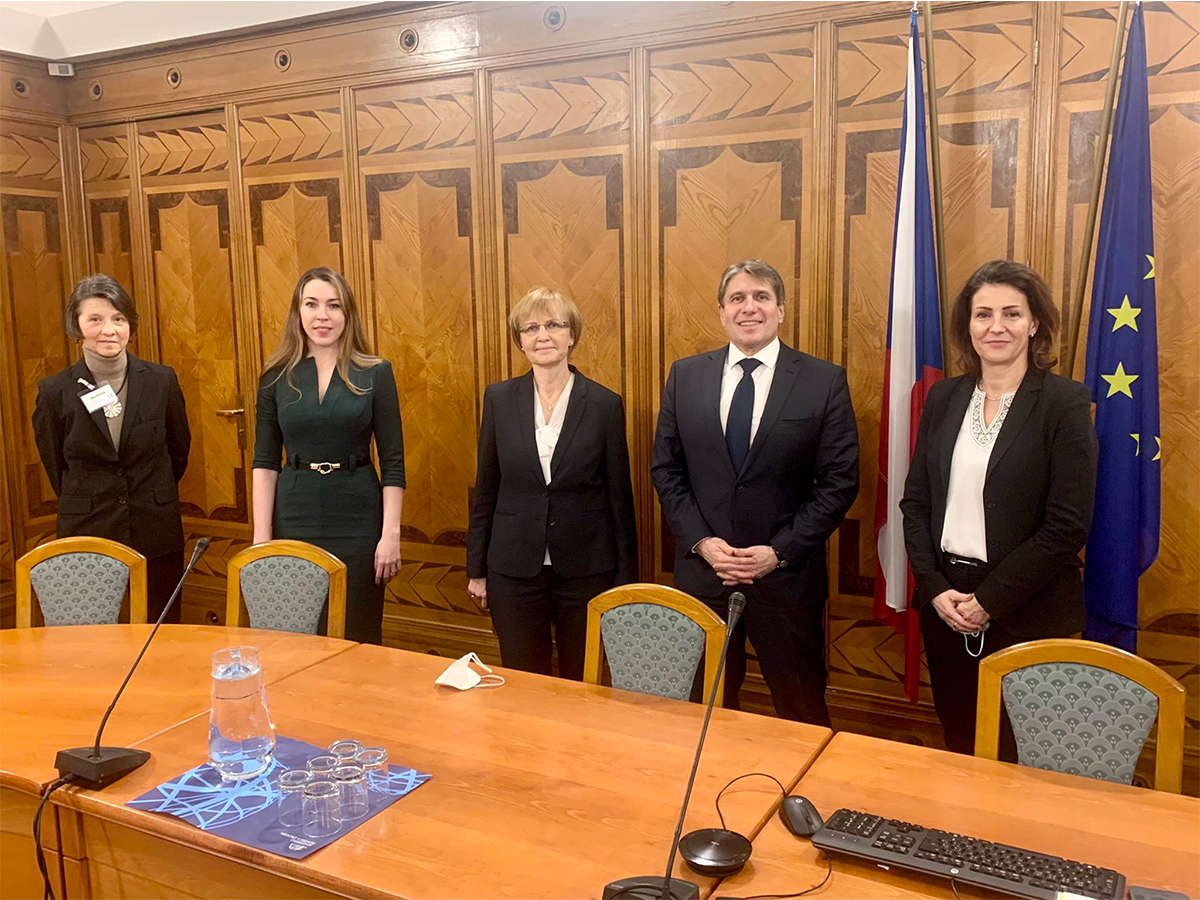

Exchanges on business priorities in view of the Czech EU Presidency

“We had good exchanges on business priorities and how to strengthen the EU Single Market and trade policy – which is promising”, said BusinessEurope Director General Markus J. Beyrer after a meeting with the Czech Deputy Minister of Industry and Trade Martina Tauberová on 6 December in Prague. In view of the upcoming Czech presidency of the Council of the EU, besides meeting with high level representatives of the Czech government, Beyrer and BusinessEurope Deputy Director General Thérèse de Liedekerke also met with board members and EU experts of the Confederation of Industry of the Czech Republic (SPCR). They discussed BusinessEurope’s key priorities, underlining the importance for European business to defend and further develop the Single Market, to stand up against overregulation and bureaucracy, and to advocate for an ambitious trade agenda and a clearer focus on how to make the green and digital transition happen.

Contact: Asdin El Habbassi

Our comment

Fit for 55: commitment – challenges – reality check

By Alexandre Affre, BusinessEurope Deputy Director General

The ‘Fit for 55’ package intends to reduce the EU’s greenhouse gas emissions by 55% by 2030 compared to 1990. The thirteen legislative proposals significantly deepen and broaden the decarbonisation of Europe’s economy, aiming to put Europe on the right path to achieve climate neutrality by 2050. The transformative nature of the package will make climate policy more visible in the daily life of Europeans and companies. In order for European businesses and industry to deliver, it is imperative that the feasibility of the plans and the costs involved are taken into account.

The ‘Fit for 55’ package intends to reduce the EU’s greenhouse gas emissions by 55% by 2030 compared to 1990. The thirteen legislative proposals significantly deepen and broaden the decarbonisation of Europe’s economy, aiming to put Europe on the right path to achieve climate neutrality by 2050. The transformative nature of the package will make climate policy more visible in the daily life of Europeans and companies. In order for European businesses and industry to deliver, it is imperative that the feasibility of the plans and the costs involved are taken into account.

Commitment

Business is committed to the transition to a climate-neutral economy by mid-century. The European industry is ready to take its share of responsibility. Building on the achievements so far, it will continue reducing its carbon footprint and bringing zero- and low-carbon technologies and solutions to society (see examples on ClimateYourBusiness).

The innovation angle is critical to the success of the transition. As the International Energy Agency pointed out, most of the global reductions in CO2 emissions through 2030 come from technologies readily available today. But in 2050, almost half of the reductions would come from technologies that are currently at the demonstration or prototype phase. In heavy industry and long-distance transport, the share of emissions reductions from technologies that are still under development today is even higher. Regulations here have to pave the way for development and market uptake of new technologies, but also will have to recognise the feasibility within companies of reducing their emissions.

The transition is expected to bring positive effects, such as growing markets for clean technologies, new wave of technological progress, abatement cost curves shifting downward, etc. For instance, the EU exported €71 billion in clean energy technologies between 2012 and 2015, creating a €11 billion trade surplus.

At the same time, Europe’s decarbonisation cannot be a lone example, it has to set off a cascade of similarly concrete steps by other big emitters. Accounting for 8% of global CO2 emissions, the EU must push others to step up their actions as well.

Challenges

Because of the magnitude of the efforts involved and the pace of the transformation implied, the accelerated transition is bound to have profound economic and social impacts. Challenges will be numerous such as the huge increase in investment needs, the risk of closures and carbon leakage, difficulties with labour reallocation, etc.

Determination over the transition to a climate-neutral economy is no reason to overlook challenges and transition costs. They are likely to be significant and therefore need to be thoroughly assessed and debated in order to minimise them as much as necessary.

The current increase in energy prices also shows how sensitive our economies are to energy prices and should therefore be thoroughly considered when discussing the ‘Fit for 55’ package.

Reality check

The overall direction set by the Fit for 55 package is right, but the economic and social viability must be checked carefully. It is critical that it does not weaken the competitiveness of our industries. A strong industrial base, with competitive companies that generate wealth, is key to mobilise the necessary investments as well as to keep and expand high-quality industry and jobs in Europe. Large-scale job-losses, as well as large increases in costs for consumers will threaten popular support for the measures, especially when consumers do not have the option to switch to climate-friendly alternatives or otherwise lower their CO2 emissions. Without popular support, the green transition will not happen, as the political situation will not allow the necessary action.

The package must undergo a reality check to see what is workable and what needs to be adjusted to make the transition consistent with our climate neutrality goal (e.g. gradual phasing out of fossil-fuels), but also economically and socially successful.

Our recent publication on the ‘Fit for 55’ package shows that important changes are necessary to strike the right balance and to ensure the right framework conditions. Have a good read here.

![]() Contact: Alexandre Affre

Contact: Alexandre Affre

International business calls for maintaining momentum in WTO

Although the 12th World Trade Organisation (WTO) Ministerial Conference has been postponed, we hope that a new date is agreed on soon. In the meantime, BusinessEurope, together with our counterparts from Brazil, Canada, Japan and the USA, issued on 2 December a joint statement urging WTO members to continue negotiations with the same commitment to achieve urgent results. In this regard, the conclusion of the negotiations on services domestic regulation is welcomed and a signal that discussions continue and deliver results. We need to see a stronger and more effective organisation, one that is able to develop and implement modern trade rules that respond to the needs of our societies. This requires continuous engagement from all WTO members, willingness to compromise and a sense of urgency to deliver tangible results in a short period of time. Global business puts emphasis on: (1) advancing the reform process in the WTO, staring with Dispute Settlement; (2) working on a trade and health Initiative; (3) achieving progress in the context of plurilateral initiatives such as e-commerce and (4) concluding the agreement on fisheries subsidies.

Although the 12th World Trade Organisation (WTO) Ministerial Conference has been postponed, we hope that a new date is agreed on soon. In the meantime, BusinessEurope, together with our counterparts from Brazil, Canada, Japan and the USA, issued on 2 December a joint statement urging WTO members to continue negotiations with the same commitment to achieve urgent results. In this regard, the conclusion of the negotiations on services domestic regulation is welcomed and a signal that discussions continue and deliver results. We need to see a stronger and more effective organisation, one that is able to develop and implement modern trade rules that respond to the needs of our societies. This requires continuous engagement from all WTO members, willingness to compromise and a sense of urgency to deliver tangible results in a short period of time. Global business puts emphasis on: (1) advancing the reform process in the WTO, staring with Dispute Settlement; (2) working on a trade and health Initiative; (3) achieving progress in the context of plurilateral initiatives such as e-commerce and (4) concluding the agreement on fisheries subsidies.

Contacts: Sofia Bournou, Elena Suárez

Stepping up social partners’ involvement in the European semester

The Joint Employment Report published as part of the autumn package 2022 made clear that more than half of all measures in the areas of business continuity, employment protection and retention, adaptation of workplaces and income protection enacted in 2021 were agreed by or negotiated with social partners. By contrast, social partners were not appropriately involved by governments in the design of their recovery and resilience plans. The return to a fully-fledged European Semester is appreciated, however, the right reforms and investments now need to be implemented at the national level. This calls for a much stronger role of social partners in the implementation phase. Next year’s social dialogue initiative by the European Commission is an important opportunity to improve social partners involvement in the European semester. In the short term, the main employment and social challenges that should be addressed through the European Semester are: shortages of labour and skills; coping with ageing through employment growth; improving skills matching; reducing inactivity rates by making use of in-work benefits, as well as making the necessary reforms of national pension systems to ensure their adequacy and sustainability in the long-term. These were the key messages of Maxime Cerutti, BusinessEurope Social Affairs Director, delivered during the joint meeting of the Council’s Employment and Social Protection Committees that was held on 7 December.

The Joint Employment Report published as part of the autumn package 2022 made clear that more than half of all measures in the areas of business continuity, employment protection and retention, adaptation of workplaces and income protection enacted in 2021 were agreed by or negotiated with social partners. By contrast, social partners were not appropriately involved by governments in the design of their recovery and resilience plans. The return to a fully-fledged European Semester is appreciated, however, the right reforms and investments now need to be implemented at the national level. This calls for a much stronger role of social partners in the implementation phase. Next year’s social dialogue initiative by the European Commission is an important opportunity to improve social partners involvement in the European semester. In the short term, the main employment and social challenges that should be addressed through the European Semester are: shortages of labour and skills; coping with ageing through employment growth; improving skills matching; reducing inactivity rates by making use of in-work benefits, as well as making the necessary reforms of national pension systems to ensure their adequacy and sustainability in the long-term. These were the key messages of Maxime Cerutti, BusinessEurope Social Affairs Director, delivered during the joint meeting of the Council’s Employment and Social Protection Committees that was held on 7 December.

Contact: Anna Kwiatkiewicz-Mory

How to ensure enforcement of sustainability provisions in EU trade deals

“Trade and Sustainable Development (TSD) chapters in EU free trade agreements are a powerful tool to foster economic, social and environmental rights, provided they are used to the maximum of their potential”, said BusinessEurope Deputy Director Eleonora Catella at the conference "What social regulations for a world in transition", organised by Science Po & NewBridges under the sponsorship of the International Labour Organisation for France on 3 December. While there has been a constant evolution of both substantive and enforcement rules, providing for a deeper engagement of civil society organisations in the monitoring of the implementation of TSD chapters, there remains room for improvement. In particular, BusinessEurope believes the EU should not be shy in triggering the existing dispute settlement mechanism whenever warranted, as it has been the case in the past. The European Commission recently launched a public consultation aiming at gathering input in view of a revision of its current approach. As additional remedies to ensure enforcement are being discussed by Institutions and stakeholders alike, “BusinessEurope remains doubtful that sanctions for non-compliance would encourage enforcement, for example, if this is due to lack of capacity. Furthermore, serious concerns arise concerning how sanctions would be disciplined if they were introduced, as a number of important aspects remains extremely vague and should be clarified”, Catella concluded.

“Trade and Sustainable Development (TSD) chapters in EU free trade agreements are a powerful tool to foster economic, social and environmental rights, provided they are used to the maximum of their potential”, said BusinessEurope Deputy Director Eleonora Catella at the conference "What social regulations for a world in transition", organised by Science Po & NewBridges under the sponsorship of the International Labour Organisation for France on 3 December. While there has been a constant evolution of both substantive and enforcement rules, providing for a deeper engagement of civil society organisations in the monitoring of the implementation of TSD chapters, there remains room for improvement. In particular, BusinessEurope believes the EU should not be shy in triggering the existing dispute settlement mechanism whenever warranted, as it has been the case in the past. The European Commission recently launched a public consultation aiming at gathering input in view of a revision of its current approach. As additional remedies to ensure enforcement are being discussed by Institutions and stakeholders alike, “BusinessEurope remains doubtful that sanctions for non-compliance would encourage enforcement, for example, if this is due to lack of capacity. Furthermore, serious concerns arise concerning how sanctions would be disciplined if they were introduced, as a number of important aspects remains extremely vague and should be clarified”, Catella concluded.

Contact: Eleonora Catella

Urgent call for a helpdesk on Taxonomy reporting

“To ensure sufficient data quality and comparability, we call on the European Commission to establish a helpdesk, supported with the necessary qualified human resources and providing transparent guidance”, wrote BusinessEurope Director General Markus J. Beyrer to the Commissioner for Financial Services, Financial Stability and Capital Markets Union Mairead McGuinness, in view of the first reporting year under the EU Taxonomy in 2022. The letter notes the many difficulties that companies face in complying with Taxonomy reporting obligations: on the one hand, the exercise is complex and costly as it requests companies to make thousands of detailed technical and accounting judgements and to ensure consistency with other disclosures; on the other hand, the rules laid down in the Taxonomy’s Climate and Art. 8 Delegated Acts are unclear and are applicable as from 1 January 2022 - i.e. leaving very short time to companies and their auditors to build common interpretations. BusinessEurope’s letter reflects that this situation does not provide companies with the adequate means to disclose reliable, comparable and relevant data, which is the very objective of the Taxonomy.

“To ensure sufficient data quality and comparability, we call on the European Commission to establish a helpdesk, supported with the necessary qualified human resources and providing transparent guidance”, wrote BusinessEurope Director General Markus J. Beyrer to the Commissioner for Financial Services, Financial Stability and Capital Markets Union Mairead McGuinness, in view of the first reporting year under the EU Taxonomy in 2022. The letter notes the many difficulties that companies face in complying with Taxonomy reporting obligations: on the one hand, the exercise is complex and costly as it requests companies to make thousands of detailed technical and accounting judgements and to ensure consistency with other disclosures; on the other hand, the rules laid down in the Taxonomy’s Climate and Art. 8 Delegated Acts are unclear and are applicable as from 1 January 2022 - i.e. leaving very short time to companies and their auditors to build common interpretations. BusinessEurope’s letter reflects that this situation does not provide companies with the adequate means to disclose reliable, comparable and relevant data, which is the very objective of the Taxonomy.

![]() Contact: Carolina Vigo

Contact: Carolina Vigo

Discussing global corporate tax reform with the EU French presidency

To ensure a level-playing field for EU businesses, it is essential that the upcoming EU implementation of the global corporate tax reforms aligns with the agreement of the Organisation for Economic Co-operation and Development (OECD) in full. This was the key-message of the Tax Policy Group when it spoke to Gael Perraud, Deputy Director of International Taxation at the French Ministry of Economy and Finance, and Bastien Lignereux, Permanent Representation of France to the EU, at its meeting on 7 December. Following a discussion on the priorities for the French presidency of the Council of the EU in the area of tax, the group stressed that Member States should carefully follow the implementation process of the OECD agreement by non-EU partners and ensure that any measure can become effective in the EU only if and when it can be established with certainty that our major trading partners implement the agreement into domestic law at the same time. In addition, the group noted that the implementation of the global tax reform remains enormously complex for multinational enterprises of all sizes and will require further detailed rules and administrative guidance to ensure legal certainty and workability.

To ensure a level-playing field for EU businesses, it is essential that the upcoming EU implementation of the global corporate tax reforms aligns with the agreement of the Organisation for Economic Co-operation and Development (OECD) in full. This was the key-message of the Tax Policy Group when it spoke to Gael Perraud, Deputy Director of International Taxation at the French Ministry of Economy and Finance, and Bastien Lignereux, Permanent Representation of France to the EU, at its meeting on 7 December. Following a discussion on the priorities for the French presidency of the Council of the EU in the area of tax, the group stressed that Member States should carefully follow the implementation process of the OECD agreement by non-EU partners and ensure that any measure can become effective in the EU only if and when it can be established with certainty that our major trading partners implement the agreement into domestic law at the same time. In addition, the group noted that the implementation of the global tax reform remains enormously complex for multinational enterprises of all sizes and will require further detailed rules and administrative guidance to ensure legal certainty and workability.

![]() Contact: Pieter Baert

Contact: Pieter Baert

Working towards real advantages for Authorised Economic Operators

BusinessEurope, together with other active associations of the Trade Contact Group of the European Commission’s Directorate-General for Taxation and Customs Union (DG TAXUD), sent a letter to DG TAXUD’s Director for Customs, Dominik Schnichels, with proposals on how to achieve real advantages for Authorised Economic Operators (AEOs). Many companies in the EU have invested a lot of administrative and financial resources to obtain AEO status in the hope of reaping the promised advantages specified in the EU Union Customs Code (UCC). Despite these investments, many simplifications, such as self-assessment and centralised clearance, have not yet been implemented. The letter urges the Commission to move forward with real and innovative simplifications for AEO status holders and proposes some ideas on how to achieve self-assessment and the implementation of the World Customs Organisation Framework of Standards to Secure and Facilitate Global Trade. We believe that the challenges and changes that customs policy will face in the near future give momentum to move forward with AEO advantages. We are open to exploring in more detail the possibilities stated in the letter and others with the Commission and relevant experts at an appropriate forum. The other associations signing the letter are: the European Automobile Manufacturers' Association, the European Shippers Council, Eurocommerce and SpiritsEurope.

BusinessEurope, together with other active associations of the Trade Contact Group of the European Commission’s Directorate-General for Taxation and Customs Union (DG TAXUD), sent a letter to DG TAXUD’s Director for Customs, Dominik Schnichels, with proposals on how to achieve real advantages for Authorised Economic Operators (AEOs). Many companies in the EU have invested a lot of administrative and financial resources to obtain AEO status in the hope of reaping the promised advantages specified in the EU Union Customs Code (UCC). Despite these investments, many simplifications, such as self-assessment and centralised clearance, have not yet been implemented. The letter urges the Commission to move forward with real and innovative simplifications for AEO status holders and proposes some ideas on how to achieve self-assessment and the implementation of the World Customs Organisation Framework of Standards to Secure and Facilitate Global Trade. We believe that the challenges and changes that customs policy will face in the near future give momentum to move forward with AEO advantages. We are open to exploring in more detail the possibilities stated in the letter and others with the Commission and relevant experts at an appropriate forum. The other associations signing the letter are: the European Automobile Manufacturers' Association, the European Shippers Council, Eurocommerce and SpiritsEurope.

![]() Contact: Elena Suárez

Contact: Elena Suárez

Calendar

- 8 - 12 February: EU Industry Days

- 28 February: Monitoring and evaluation in lifelong guidance – towards future European standards?

Not yet a subscriber? Register here.

Reminder: please have a look at our privacy policy