Why completing Banking Union in 2018 is a priority for EU businesses

Deepening the Economic and Monetary Union and in particular completing the banking union is likely to be a key topic for discussion amongst EU policy-makers in 2018, and we hope that EU leaders will be able to make firm decisions to stengthen our common currency, as scheduled in June. In particular, a full banking union must be put in place, with rapid agreement and implementation of an EU deposit insurance scheme, alongside the existing supervision and resolution pillars, needed to address the continued fragmentation of EU savings and credit markets.

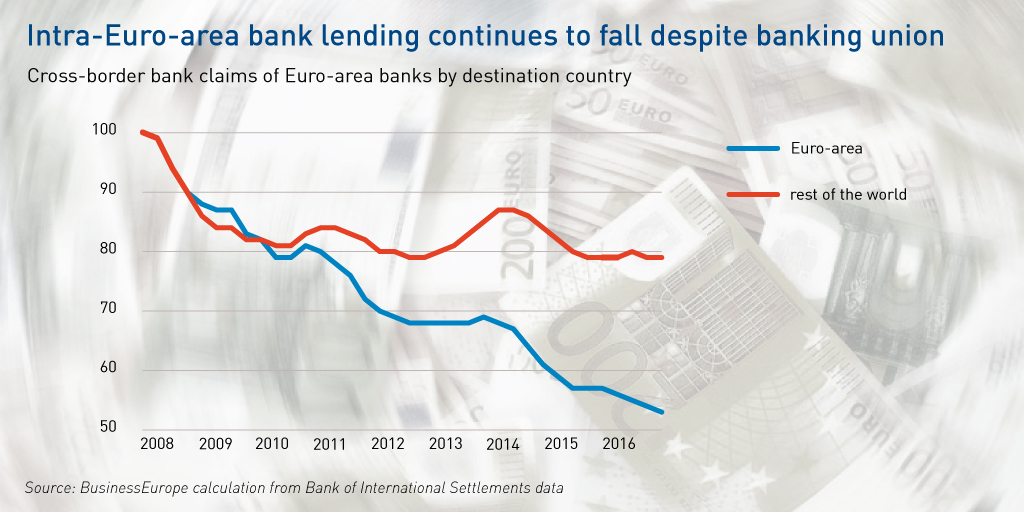

The chart below illustrates this fragmentation by showing the claims held by Euro-area banks in different countries. As is well known, following the financial crisis, banks across the globe reduced their international lending, and Euro-area banks were no exception to this. But whilst Euro-area banks now feel more confident in lending again outside of the EU, their lending to other banks, institutions and firms within the Euro-area, but outside of the own member state has continued to fall, despite the first steps being put in place to complete the banking union. As the European Central Bank has pointed out, greater cross-border banking can increase financial stability and competiton in the banking sector, ultimately improving the availability of finance for firms to invest - meaning completing banking union really is a priority in 2018.